It’s a federal crime for a banking employee to fraudulently certify a check before funds are available in a banking account. If you’re convicted of this offense, you could face steep fines and up to five years in federal prison. Please contact a skilled criminal defense attorney now if you or a loved one is facing any type of federal criminal charge.

What is the Federal Law on Fraudulent Certification of Checks?

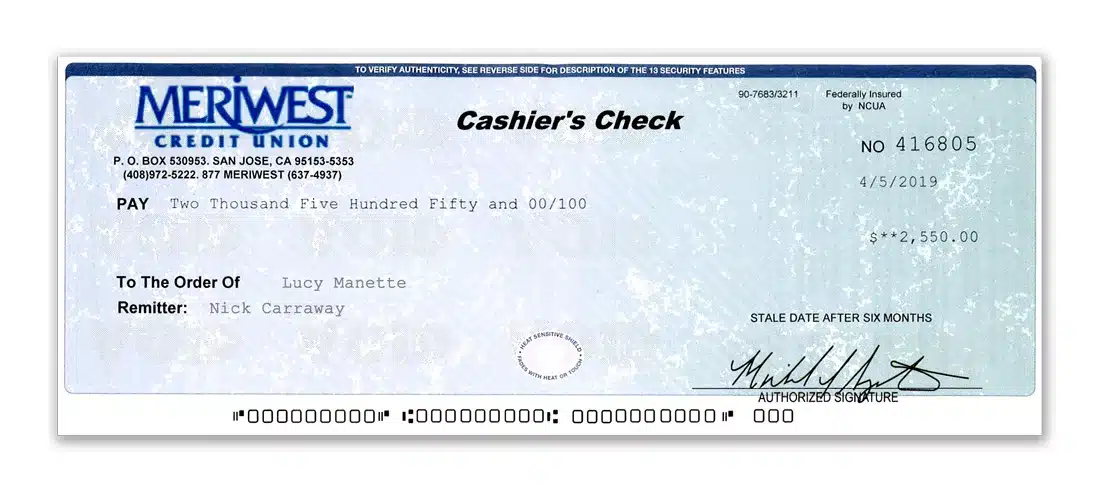

18 U.S.C 1004 is the statute that sets forth the federal law on the fraudulent certification of checks. This statute essentially prohibits any officer, director, agent, or employee of any banking institution from certifying a check without verifying that the drawer of the check (i.e., the person or organization issuing the check) has sufficient funds in their account to cover the check.

Specifically, 18 U.S.C. 1004 makes it a federal crime to do either of the following:

- To certify a check before funds are available in the account, or

- To do any other activity or “workaround” that attempts to manipulate or bypass this requirement.

Note that, in general, “check certification” is when an official or employee of a financial institution, such as a bank, certifies sufficient funds in the account on which a check is drawn to cover it. This certification is critical to ensure that checks are correctly presented and accepted when adequate funds are available for payment.

What are the Penalties?

Fraudulently certifying a check is a federal felony offense that is punishable by:

- Fines of up to $250,000, and

- Up to five years in prison.

Can a Defendant Raise a Legal Defense?

Yes. People charged with violating 18 U.S.C. 1004 can contest the charge with a legal defense. A common defense is for an accused to show that he or she had no intent to defraud. In particular, a defense attorney can argue that a false certification was a mistake rather than a fraudulent intent to break the law.

Your criminal defense attorney can also try and argue that there was no knowledge of insufficient funds. Your lawyer may show that at the time you certified the check, to the best of your knowledge, you believed the funds were available to cover the check.

Finally, your defense attorney may argue that you acted under duress. Your attorney could present evidence that you committed the act because you were threatened or felt a real and immediate threat of harm to yourself or your family if you did not commit a crime. While this defense doesn’t necessarily absolve you of the crime, it can lead to leniency or dropped charges.

Contact Black & Askerov for Help

While a defendant can raise a legal defense to challenge a fraudulent certification of check charge, it will take a skilled criminal defense attorney to raise the best defense. The experienced federal crime attorneys at Black & Askerov have over 30 years of combined experience defending clients on various federal offenses. Our Seattle criminal defense lawyers also have the skill and commitment that makes all the difference in these cases. Our attorneys will fight tooth and nail for you at every step of your case. Contact us now to get the legal help you deserve!